Greetings,

Please see latest update on CCS from Waka Kotahi NZTA:

Counting down to 1 January

Kia ora

Welcome to the last update for the year from the Clean Car Standard (CCS) programme.

As Christmas approaches, we’d like to thank the motor vehicle industry for engaging with us over the past year as we’ve progressed the CCS.

Our aim is to make it as easy as possible to comply with the Standard which comes into effect on 1 January 2023. We’ve developed the CCS system to automate most of the processing for light motor vehicle importers.

You may have heard that accounts operating as Pay as You Go have had charge payments deferred until 1 June 2023. Don’t be confused by this. Charges incurred start from 1 January 2023. What is deferred is the date by which these charges are due to be paid. Charges will become due on 1 June 2023.

In the CCS System from 1 January 2023, you’ll see charges and credits in the system, and other functions will become available as the year progresses. Please make sure that you keep track of your overall credit/charge position to ensure you are prepared for charges due on 1 June 2023 and have factored this into your finances. We have provided guides, videos and website information to prepare you for the changes.

We’ll continue to provide ongoing support through our CCS team and we’re holding more webinars in mid-January to answer any of your questions.

You can also visit our website www.nzta.govt.nz/clean-car-standard/ where we have the guides and videos available.

All the best for a safe and happy holiday break and we’ll be back in touch in the new year.

Ngā mihi

The Clean Car Standard team

Key 1 January CO2 account changes

From 1 January 2023, you’ll see the CCS CO2 emissions, target emissions and CO2 differences for vehicles in your CO2 account.

Pay as You Go importers, will see the corresponding credits and charges, and Fleet Average importers will see how they’re tracking against the annual targets.

You must ‘accept’ each vehicle. For new vehicles, acceptance is needed after the PDI is recorded to complete the WoF. For used vehicles, acceptance is needed to enable registration. This is a change from the December process where vehicles were automatically accepted by the system.

CO2 account holders will have the ability to reject or dispute vehicles if they believe the CCS CO2 values are incorrect or a vehicle doesn’t belong to them. They will use the ‘dispute’ vehicle option in the Vehicle information screen to do this.

From the end of February for Pay as You Go importers, we will email account owners a monthly update of pending charges. This statement is not an invoice, it’s to keep you informed of your position ahead of 1 June. Your account balance is always available to view in the account summary at the top of the screen, or in the Pending charges tab.

Tips

Go into the CCS system and familiarise yourself with how it works so you’re ready for 1 January.

Check accounts regularly, so ‘acceptance’ of vehicles doesn’t hold up your processes.

Keep an eye on the charges accumulating in your account so there are ‘no surprises’ when charges are invoiced in June.

If you can’t find a vehicle you expected to be in your CCS CO2 account, contact the CCS team.

If you want to be on Fleet Average, submit your application as soon as possible as the assessment process takes time to complete.

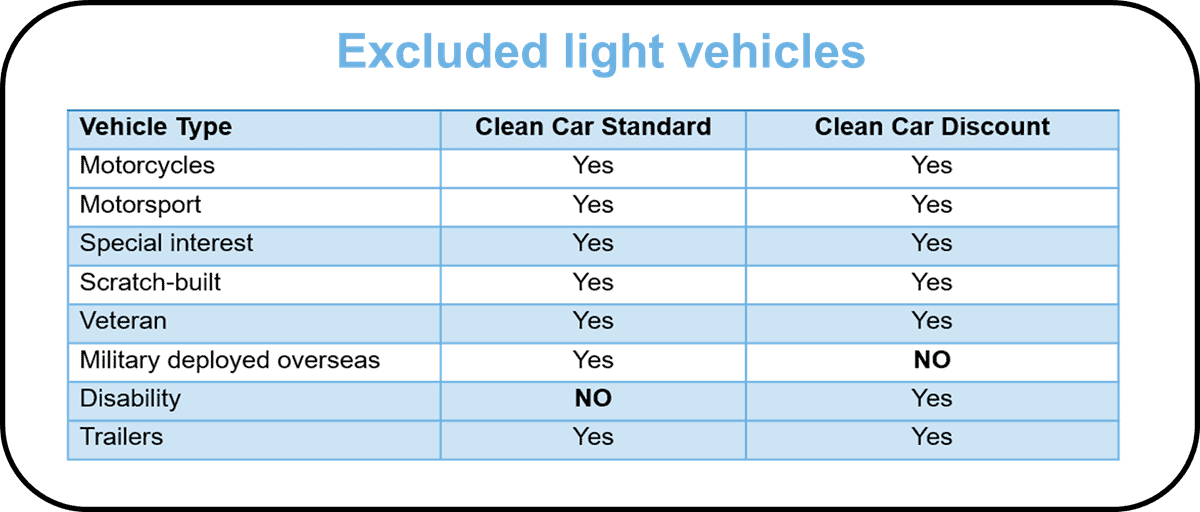

Vehicles excluded from the Clean Car Standard

The CCS applies to all light vehicles, except those listed in the table above.

Excluded light vehicles are not the same for Clean Car Discount and CCS.

Excluded vehicles still require a CCS CO2 account in the CCS system (except motorcycles and trailers). In early 2023 we plan to remove the requirement for excluded vehicles to have a CSS CO2 account.

Excluded vehicles are not subject to CO2 targets, they don’t have CO2 charges or credits and you don’t need to accept them in the CCS system.